EPF Account Balance (End of June 2018) = Rs 23,508.EPF Account Balance (Start of June 2018) = Rs 15,670.EPF Account Balance (End of May 2018) = Rs 15,670.EPF Account Balance (Start of May 2018) = 7835.Interest on EPF Balance (April 2018) = Nil (No interest in the first month).EPF Account Balance (End of April 2018) = Rs 7835.EPF contribution (April 2018) = Rs 7835.EPF Account Balance (Start of April 2018) = Rs 0.So your and your employer’s EPF contributions started for the financial year 2018 – 2019 from the month of April. So the EPF interest rate applicable per month is = 8.65%/12 = 0.7083%Īssume that you (the employee in this case) joined the job exactly on 1 st April 2018. So let’s use this for the example.Īs mentioned earlier, interest on EPF is calculated monthly. The EPF interest rate for FY 2018-2019 was 8.65%. So the Total EPF contribution every month = Rs 6000 + Rs 1835 = Rs 7835. Employer’s contribution towards EPF = 3.67% of Rs 50,000 = Rs 1835.Employer’s contribution towards EPS = 8.33% of Rs 50,000 = Rs 4165.Employee’s contribution towards EPF = 12% of Rs 50,000 = Rs 6000.Now following are the contributions made by you (employee) and the employer: Lets say your salary (Basic Salary + Dearness Allowance) = Rs 50,000 per month. The important thing to understand here is that EPF interest is computed each month but it is deposited once only at the end of the financial year. The calculator takes the EPF contributions of the employee and the employer, and then calculates the interest on the contribution during that year and also on the EPF balance at the start of the year. You can also check the past changes in historical EPF interest rates. EPF Interest Rate: As of now, the EPF interest rate is 8.50% (FY 2019-20).But since this is a simple calculator, we keep it at 3.67% in EPF as Employer’s Contribution.

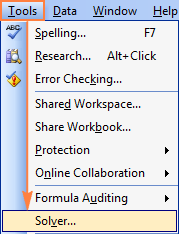

DOWNLOAD SOLVER FOR EXCEL ONLINE FREE

And the employer is free to use any one of the methods. But if the income exceeds the wage threshold of Rs 15,000, then there are 3 standard methods for calculating the contribution amount. In reality, the contributions are made on a wage ceiling (Basic Salary + DA) or new salary threshold of Rs 15,000. The Employer’s EPF Contribution is divided between 3.67% into EPF and 8.33% into EPS. Employer EPF Contribution: Employers also contribute 12% but it is distributed across the EPF (Employee Provident Fund) and the EPS (Employee Pension Scheme).As per latest EPF rules, the employee contribution is 12% of Basic Pay + Dearness Allowance. Employee EPF Contribution: This is your contribution towards your EPF corpus.Let’s talk a bit about a few of the above in more detail Once you provide these inputs, the EPF Calculator does all the hard work for you and tell you How much EPF Corpus is accumulated by Retirement. Employer’s EPF Contribution (as a % of Salary) – Generally 3.67%.Employee’s EPF Contribution (as a % of Salary) – Generally 12%.EPF Interest Rate: Current EPF Interest rate is 8.65%.Expected Increase in Salary every year (in percentage).Your Monthly Salary (Basic Pay + Dearness Allowance).

Let me briefly tell you what inputs are required to use this Employee Provident Fund Calculator:

DOWNLOAD SOLVER FOR EXCEL ONLINE DOWNLOAD

So here is the link to download it free: Download (FREE) Employee Provident Fund Excel Calculator (2022) But whatever you wish to call it, it is a simple, easy-to-use and can be used as a Provident Fund Calculator as well. You can also call this calculator as EPF maturity calculator. This EPF calculator acts as a tool that you can use to estimate the EPF retirement corpus when you retire at 60 or even earlier. How much tax-free withdrawal is allowed from EPF at retirement?įor answering these and similar EPF corpus calculation related questions, I have created a small free excel EPF Corpus Calculator 2022.How much EPF retirement corpus will I have?.How much money can you accumulate in EPF by retirement?.So if you are a salaried employee who regularly contributes to his / her Employee Provident Fund EPF Account, then you would be interested in knowing the following: A good yet simple Employee Provident Fund Calculator or EPF Calculator can tell you many useful things like EPF Maturity value among other things.

0 kommentar(er)

0 kommentar(er)